This workshop is tailored specifically for salaried individuals and HR/accounting professionals responsible for employee tax matters. It focuses on the correct preparation and filing of income tax returns for salaried persons, including salary breakup, tax deductions, exemptions, and submission through the IRIS portal.

Participants will also understand how to reconcile salary certificates with tax declarations, claim allowable credits (e.g., donations, investments), and avoid errors that may result in FBR notices.

How is this Workshop Helpful?

Salaried individuals often face confusion around tax deduction adjustments and accurate wealth reporting. This workshop clarifies the process and helps ensure compliance—especially for those new to filing or switching jobs, receiving bonuses, or other non-standard components.

What Will You Be Able to Do After Attending?

-

File your salaried income tax return through IRIS confidently

-

Claim applicable exemptions and tax credits

-

Verify and reconcile salary certificates with return data

-

Understand your tax liability and deduction adjustments

-

Prepare supporting documentation to avoid compliance issues

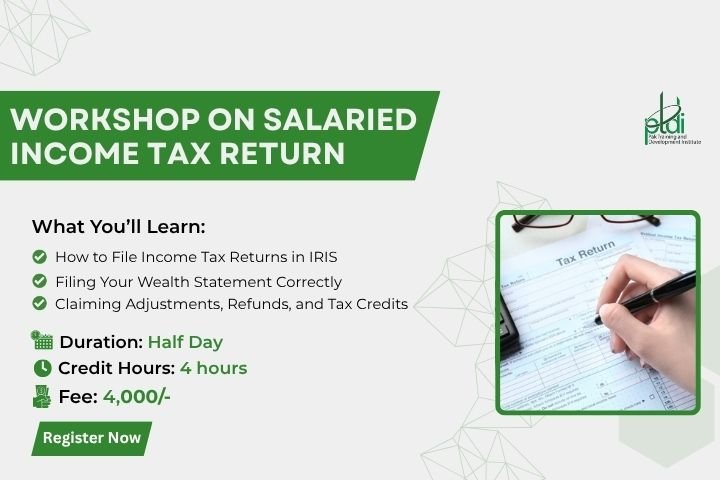

What Will You Learn?

- Understand who is required to file an Income Tax Return in Pakistan

- Navigate the IRIS system step-by-step for return and wealth statement filing

- Declare multiple income sources (salary, business, property, capital gains)

- Differentiate between Active Filer and Non-Filer status and its impact

- Correctly fill out the Wealth Statement and reconcile with income

- Apply exemptions, tax credits, and allowable deductions

- Track carried forward losses, depreciation, and refund claims

- Avoid common errors that lead to audit selection

- Learn the timelines, penalties, and consequences of late or incorrect filing

- Build a habit of maintaining financial records for future returns

Student Ratings & Reviews